A Biased View of Commercial Insurance In Dallas Tx

Wiki Article

Excitement About Truck Insurance In Dallas Tx

Table of ContentsFascination About Insurance Agency In Dallas TxThe Greatest Guide To Truck Insurance In Dallas TxAbout Commercial Insurance In Dallas TxFascination About Home Insurance In Dallas TxNot known Facts About Truck Insurance In Dallas TxHome Insurance In Dallas Tx for Beginners

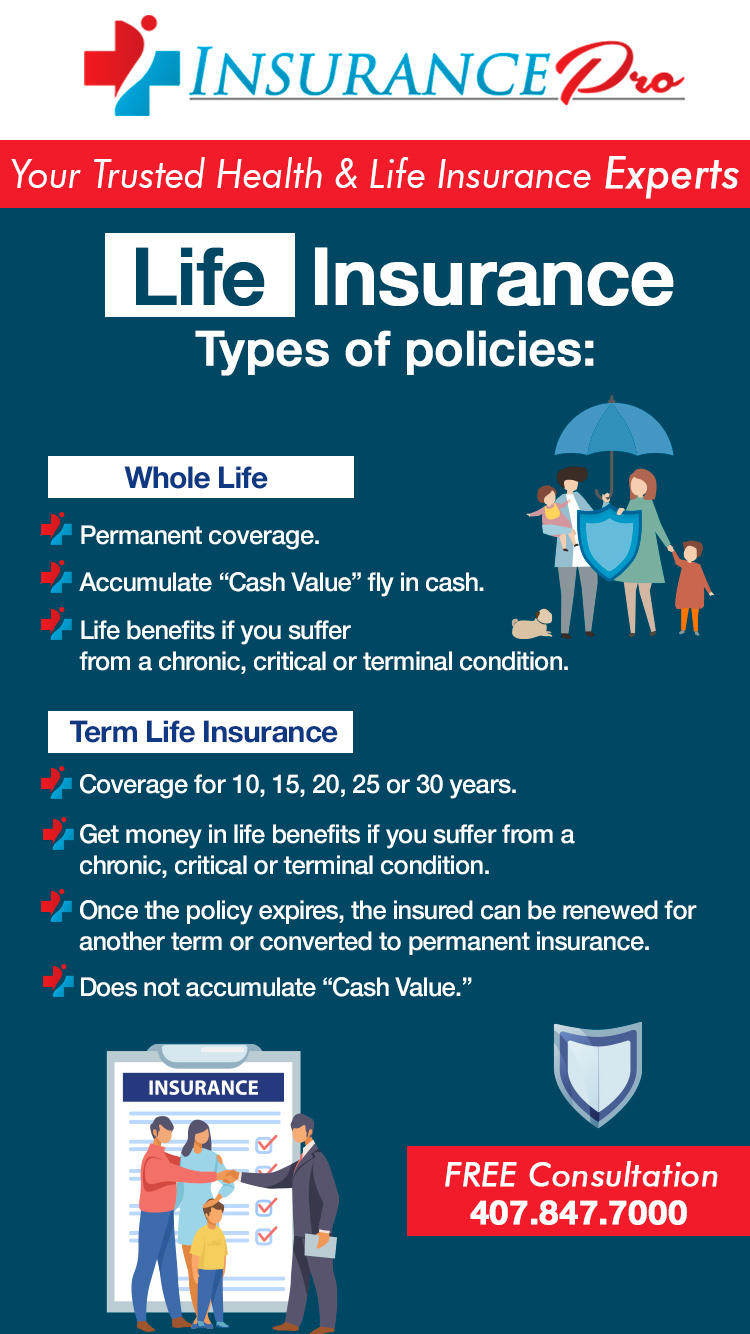

As well as considering that this insurance coverage lasts for your entire life, it can aid sustain long-lasting dependents such as kids with handicaps. Con: Cost & intricacy an entire life insurance policy plan can be considerably a lot more pricey than a term life plan for the exact same survivor benefit amount. The cash value part makes entire life more complicated than term life due to fees, tax obligations, passion, as well as various other stipulations.

Bikers: They're optional add-ons you can use to personalize your policy. Term life insurance plans are generally the finest solution for individuals that require economical life insurance policy for a details period in their life.

Home Insurance In Dallas Tx Things To Know Before You Buy

" It's constantly recommended you talk to a qualified agent to establish the ideal solution for you." Collapse table Currently that you recognize with the basics, below are added life insurance policy plan types. Numerous of these life insurance policy choices are subtypes of those featured over, implied to serve a certain objective.Pro: Time-saving no-medical-exam life insurance policy provides quicker access to life insurance policy without needing to take the medical exam (Life insurance in Dallas TX). Con: Individuals who are of old age or have multiple health problems could not be eligible. Best for: Any individual who has couple of health and wellness problems Supplemental life insurance policy, additionally called volunteer or voluntary extra life insurance policy, can be used to connect the coverage gap left by an employer-paid group plan.

Unlike various other plan kinds, MPI only pays the death benefit to your mortgage lender, making it a a lot more restricted alternative than a typical life insurance plan. With an MPI policy, the recipient is the home loan business or lender, as opposed to your family, and also the fatality benefit lowers over time as you make home mortgage settlements, comparable to a reducing term life insurance coverage plan.

The Buzz on Home Insurance In Dallas Tx

Because AD&D only pays under specific conditions, it's not an ideal alternative to life insurance policy. AD&D insurance policy only pays if you're injured or eliminated in a crash, whereas life insurance policy pays for most causes of fatality. Because of this, AD&D isn't suitable for every person, however it might be useful if you have a risky occupation.

Indicators on Health Insurance In Dallas Tx You Should Know

Best for: Pairs who do not qualify for 2 individual life insurance policy policies, There are two primary kinds of joint life insurance policy plans: First-to-die: The plan pays after the very first of both spouses dies. First-to-die is the most comparable to a private life insurance plan. It aids the surviving insurance discover this info here policy holder cover expenses after the loss of financial backing.What are the two main types of life insurance? Term as well as long-term are the two primary kinds of life insurance.

Both its period and cash money value make irreversible life insurance policy sometimes more expensive than term. What is the least expensive sort of life insurance policy? Term life insurance coverage is typically one of the most inexpensive and extensive sort of life insurance a fantastic read policy because it's straightforward and also gives economic defense during your income-earning years. Exactly how much you pay for life insurance coverage, nevertheless, will certainly rely on your age, sex, way of life, as well as health and wellness.

How Home Insurance In Dallas Tx can Save You Time, Stress, and Money.

Whole, universal, indexed universal, variable, as well as interment insurance policy are all kinds of long-term life insurance policy. Long-term life insurance policy commonly includes a money worth and also has higher premiums. What is the most common kind of life insurance policy? Term life as well as whole life are the most popular kinds of life insurance policy.life insurance policy market in 2022, according to LIMRA, the life insurance coverage research study company. Term life costs stood for 19% of the market share in the exact same duration (bearing in mind that term life premiums are much cheaper than entire life premiums).

There are 4 fundamental parts to an insurance coverage agreement: Affirmation Web page, Insuring Contract, Exemptions, Problems, It is crucial to comprehend that multi-peril policies may have details exemptions and problems for every kind of insurance coverage, such as Go Here accident coverage, medical repayment coverage, responsibility coverage, and so forth. You will certainly need to ensure that you review the language for the certain insurance coverage that relates to your loss.

Some Known Details About Commercial Insurance In Dallas Tx

g. $25,000, $50,000, and so on). This is a summary of the significant assurances of the insurance firm as well as states what is covered. In the Insuring Agreement, the insurance firm agrees to do particular things such as paying losses for protected dangers, providing specific services, or accepting safeguard the insured in a responsibility claim.Instances of omitted building under a property owners plan are individual home such as a car, an animal, or an aircraft. Problems are provisions put in the policy that qualify or position constraints on the insurer's guarantee to pay or execute. If the policy conditions are not satisfied, the insurance company can reject the case.

Report this wiki page